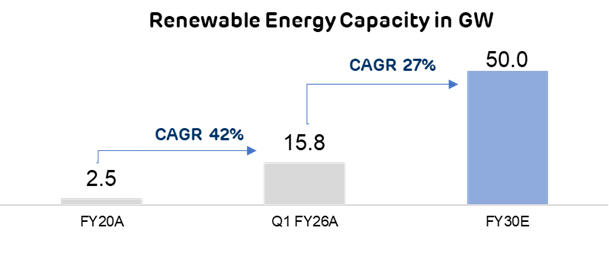

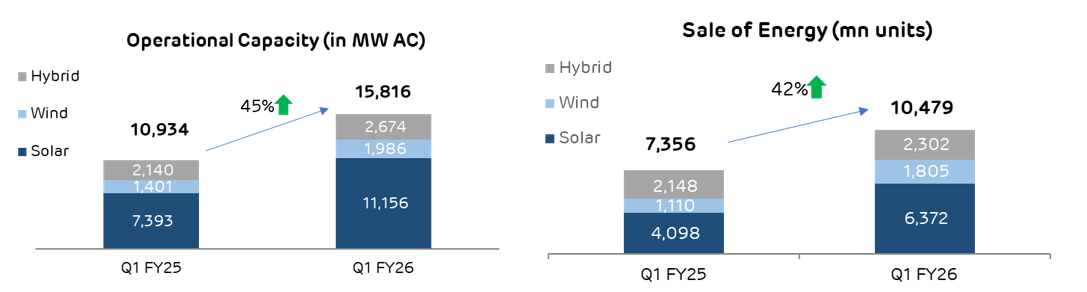

Operational RE capacity grows 45% YoY to 15.8 GW, continues to be India’s largest

Greenfield addition of 1.6 GW in Q1 FY26 and 4.9 GW over last one year, setting an unprecedented milestone in India’s renewable journey

Ranked 1st in FTSE Russell ESG score in Alternative Electricity subsector globally

Ahmedabad, 28 July 2025: Adani Green Energy Ltd (AGEL), India’s largest and fastest-growing pure-play renewable energy (RE) company, has announced financial results for the period ending 30 June 2025, showcasing remarkable growth and operational excellence.

FINANCIAL PERFORMANCE – Q1 FY26: (Rs. in crore)

| Particulars | Quarterly Performance | ||

|---|---|---|---|

| Q1 FY25 | Q1 FY26 | % change | |

| Revenue from Power Supply | 2,528 | 3,312 | 31% |

| EEBITDA from Power Supply 1 | 2,374 | 3,108 | 31% |

| EBITDA from Power Supply (%) | 92.6% | 92.8% | |

| Cash Profit 2 | 1,394 | 1,744 | 25% |

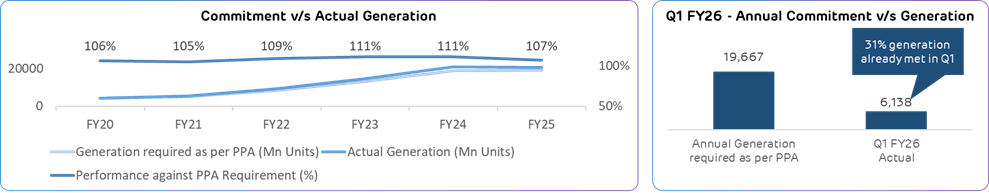

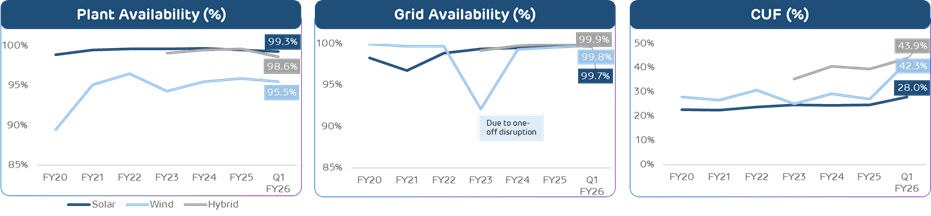

- Strong revenue, EBITDA and Cash profit growth is primarily backed by robust greenfield capacity addition of 4.9 GW, deployment of advanced RE technologies, superior plant performance and deployment of new capacities in resource rich sites in Khavda, Gujarat and Rajasthan.

Mr. Ashish Khanna, CEO of Adani Green Energy, shared, “During Q1 FY26, we added 1.6 GW of greenfield renewable energy capacity, bringing our total increase to 4.9 GW over the past year—an achievement unmatched in India’s transition toward clean energy. Our investments in the massive RE development at Khavda in Gujarat as well as other resource-rich sites are delivering results both in terms of superior operational performance and industry-best EBITDA margins. We are on track to achieve our 2030 target of 50 GW RE capacity with at least 5 GW of hydro pumped storage along with battery storage. Further, battery storage is also a key part of our future strategy. We remain committed to supporting national energy transition and security ambitions as well as maintaining our ESG leadership, highlighted by our top rankings in the FTSE Russel ESG assessment and recognition at the Reuters Global Energy Transition Awards 2025.”

CAPACITY ADDITION & OPERATIONAL PERFORMANCE – Q1 FY26:

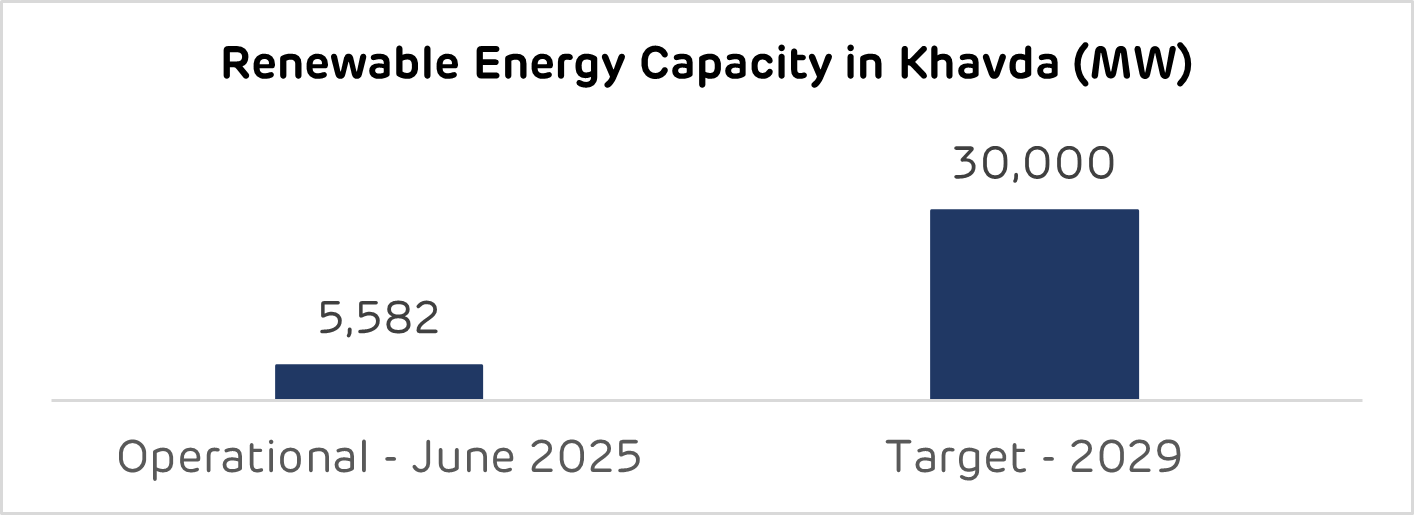

The greenfield additions over the last one year included 3,763 MW of solar capacity in Khavda, Gujarat (2,463 MW), Rajasthan (1,050 MW) and Andhra Pradesh (250 MW); 585 MW wind capacity in Khavda and 534 MW of solar-wind hybrid capacity in Khavda.

DEVELOPMENT OF THE WORLD’S LARGEST RE PLANT AT KHAVDA:

ESG LEADERSHIP:

We Care About Your Privacy

We use cookies to give you the best experience on our website. By continuing, you're agreeing to our use of cookies. For more information read our Privacy Policy or edit your preferences

Essential for site operation. < Enables core functions like security and accessibility.

Remembers your settings like language & region.

Anonymous data to improve performance.

Enhanced features like videos & chat.

Improves outreach & measures engagement.