Ahmedabad, 1 May 2025: Adani Ports and Special Economic Zone Limited (APSEZ) announced results for the quarter and twelve months ending 31st March, 2025.

| Particulars (₹ Cr) | Q4 FY25 | Q4 FY24 | YoY | FY25 | FY24 | YoY |

|---|---|---|---|---|---|---|

| Cargo (MMT) | 118 | 109 | 8% | 450 | 420 | 7% |

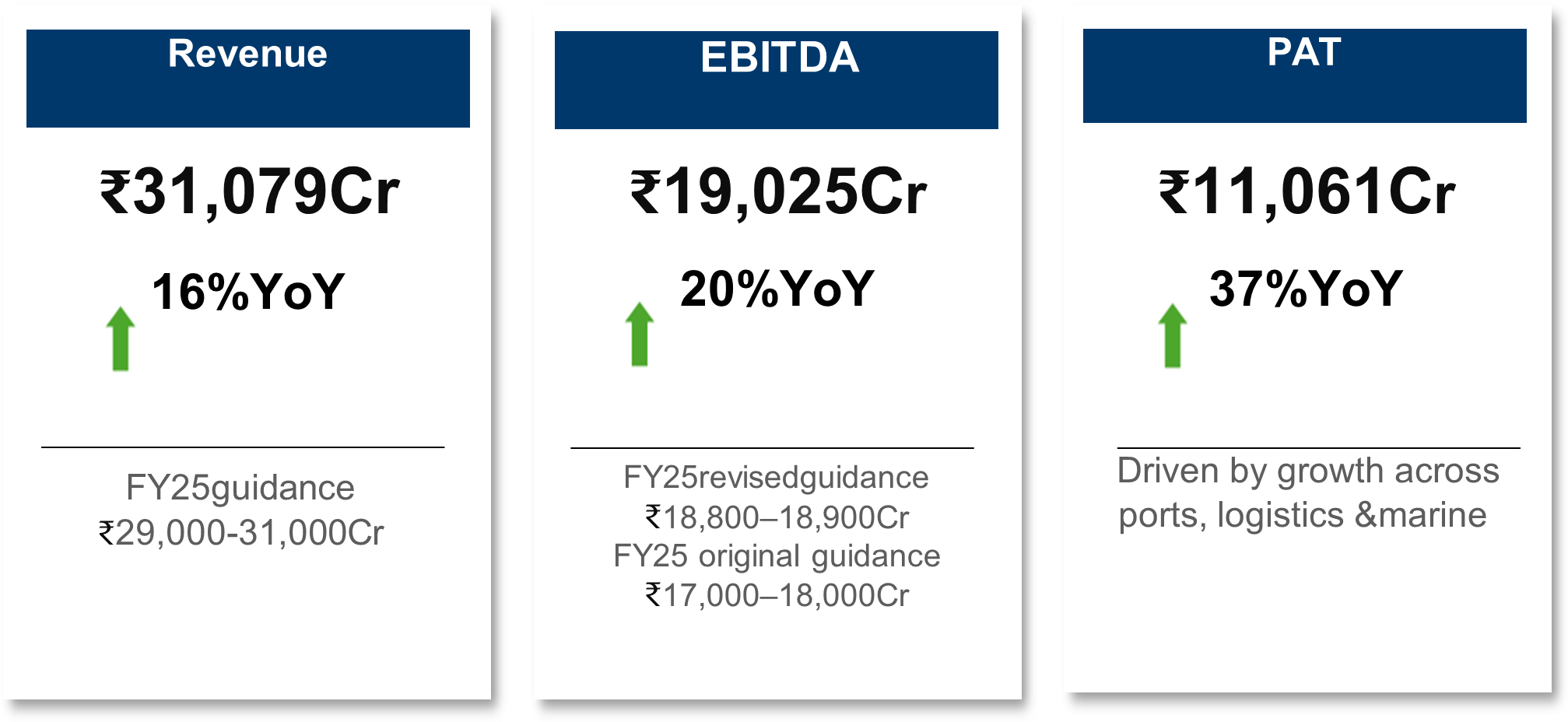

| Revenue | 8,488 | 6,897 | 23% | 31,079 | 26,711 | 16% |

| EBITDA | 5,006 | 4,044 | 24% | 19,025 | 15,864 | 20% |

| PAT* | 3,023 | 2,015 | 50% | 11,061 | 8,104 | 37% |

“Our record-breaking performance in FY25—crossing ₹11,000 Cr in PAT and handling 450 MMT cargo—is a testament to the power of integrated thinking and flawless execution,” said Mr. Ashwani Gupta, Whole-time Director & CEO, APSEZ. “We have outperformed guidance across all metrics, expanded our footprint across India and globally, and transformed our logistics and marine verticals into engines of future growth. From Mundra crossing 200 MMT, to Vizhinjam rapidly achieving 100,000 TEUs, to the strategic acquisitions of NQXT and Astro Offshore—every milestone reflects our long-term vision to become the world’s largest ports and logistics platform. With robust fundamentals, industry-leading ESG ratings and an unwavering commitment to excellence, we are well-positioned for even greater strides in FY26.”

Strategic highlights

Operational highlights

Financial highlights

FY26 guidance

| Parameter | FY26 guidance |

|---|---|

| Revenue | ₹36,000-38,000 Cr |

| EBITDA | ₹21,000-22,000 Cr |

| Capex | ₹11,000-12,000 Cr |

| Net debt / EBITDA | Policy up to 2.5x |

Port cargo volume guidance – 505-515 MMT

ESG highlights

Awards & accolades

*During FY24, based on future estimated future profits, APSEZ switched to the new tax regime (u/s 115 BAA of the Income Tax Act, 1961) for one of its subsidiaries, AKPL. Consequently, past years MAT was written off which reduced the FY24 PAT by ₹455 Cr

We Care About Your Privacy

We use cookies to give you the best experience on our website. By continuing, you're agreeing to our use of cookies. For more information read our Privacy Policy or edit your preferences

Essential for site operation. < Enables core functions like security and accessibility.

Remembers your settings like language & region.

Anonymous data to improve performance.

Enhanced features like videos & chat.

Improves outreach & measures engagement.