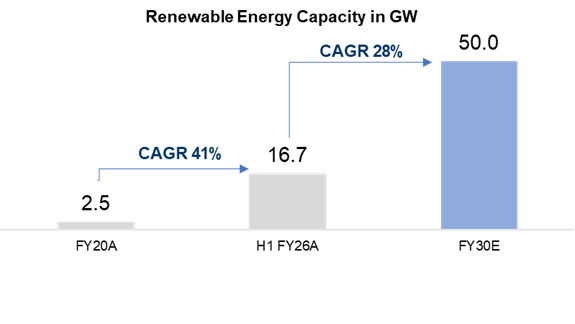

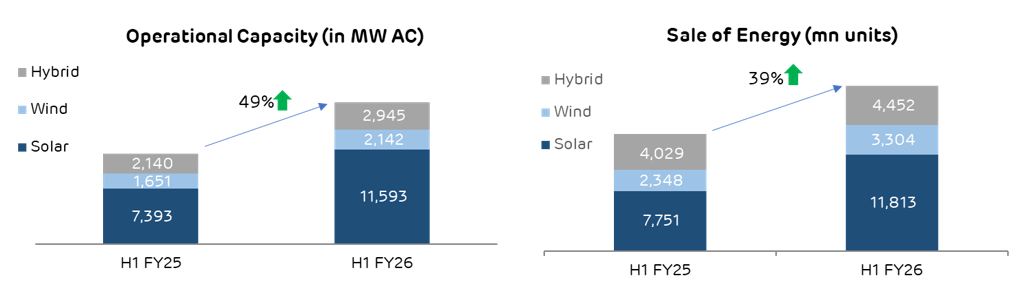

Operational RE capacity grows 49% YoY to 16.7 GW, continues to be India’s largest

Greenfield addition of 2.4 GW in H1 FY26, which is 74% of capacity addition in entire FY25

EBITDA grows 25% YoY at Rs. 5,651 crore in H1 FY26, exceeding annual EBITDA for FY23

Ahmedabad, 28 October 2025: Adani Green Energy Ltd (AGEL), India’s largest and fastest-growing pure-play renewable energy (RE) company, has announced financial results for the period ending 30 September 2025, showcasing remarkable growth and operational excellence.

FINANCIAL PERFORMANCE – Q2 & H1 FY26: (Rs. in crore)

| Particulars | Quarterly Performance | Half Yearly Performance | ||||

|---|---|---|---|---|---|---|

| Q2 FY25 | Q2 FY26 | % change | H1 FY25 | H1 FY26 | % change | |

| Revenue from Power Supply | 2,308 | 2,776 | 20% | 4,836 | 6,088 | 26% |

| EEBITDA from Power Supply 1 | 2,143 | 2,543 | 19% | 4,518 | 5,651 | 25% |

| EBITDA from Power Supply (%) | 91.7% | 90.5% | 92.2% | 91.8% | ||

| Cash Profit 2 | 1,252 | 1,349 | 8% | 2,646 | 3,094 | 17% |

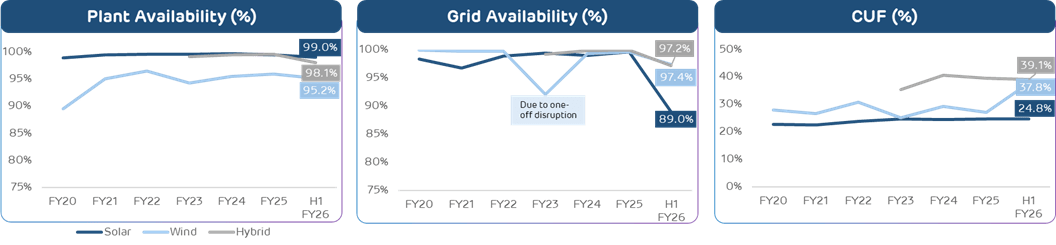

- Strong revenue, EBITDA, and cash profit growth are primarily backed by robust greenfield capacity addition of 5.5 GW, deployment of advanced RE technologies, strong plant performance and commissioning of new capacities in resource rich sites in Khavda, Gujarat and Rajasthan.

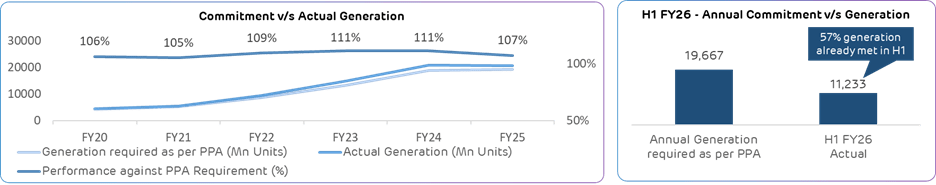

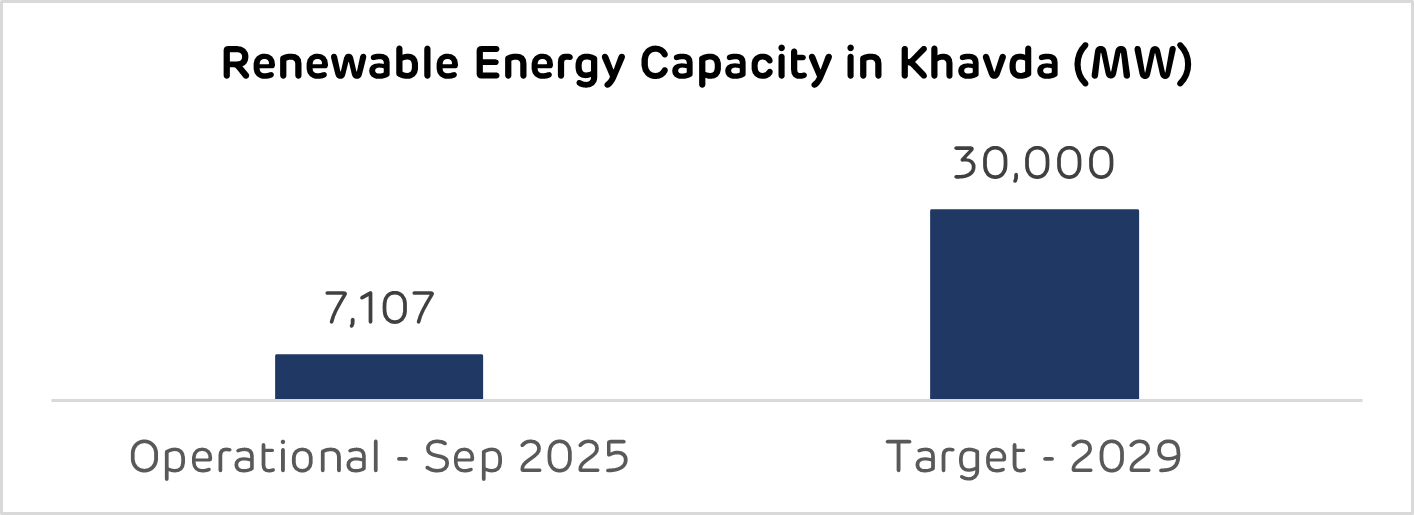

Mr. Ashish Khanna, CEO of Adani Green Energy, said, “Having already added 2.4 GW RE capacity in H1 FY26, we're on a firm path to 5 GW capacity addition in FY26 and reaching our targeted capacity of 50 GW by 2030. With relentless efforts by our team, we are making steady progress in our largest ongoing development of 30 GW RE plant at Khavda in Gujarat. For the half year ended September 2025, our operational capacity stands at 16.7 GW, continues to be the largest in India. We produced 19.6 billion units of clean power—enough to supply a country like Croatia for an entire year. We’re consistently adopting innovative renewable technologies and digitalizing ever more aspects of our business to boost operational efficiency, project execution and safety. The ongoing recognition of our ESG initiatives reinforces our dedication to sustainable growth and commitment to lead India’s energy transition.”

CAPACITY ADDITION & OPERATIONAL PERFORMANCE – H1 FY26:

AGEL added 2,437 MW greenfield capacity in H1 FY26, which is 74% of capacity addition in entire FY25. The greenfield additions over the last one year were 5,496 MW which included 4,200 MW of solar capacity (2,900 MW in Khavda, Gujarat, 1,050 MW in Rajasthan and 250 MW in Andhra Pradesh); 491 MW wind capacity in Khavda and 805 MW of solar-wind hybrid capacity in Khavda.

DEVELOPMENT OF THE WORLD’S LARGEST RE PLANT AT KHAVDA:

ESG LEADERSHIP:

We Care About Your Privacy

We use cookies to give you the best experience on our website. By continuing, you're agreeing to our use of cookies. For more information read our Privacy Policy or edit your preferences

Essential for site operation. < Enables core functions like security and accessibility.

Remembers your settings like language & region.

Anonymous data to improve performance.

Enhanced features like videos & chat.

Improves outreach & measures engagement.