Emerged as World’s No. 1 Green Utility in latest annual rankings by Energy Intelligence

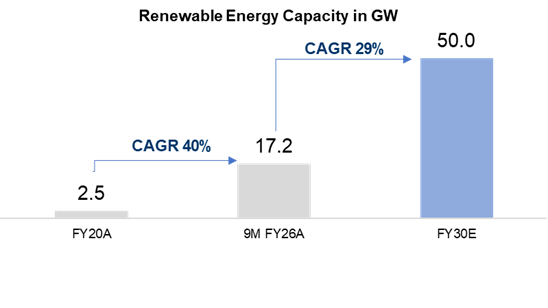

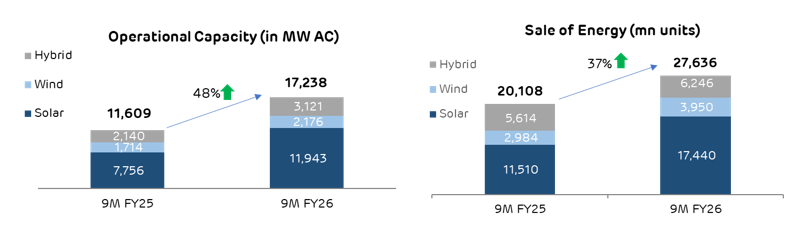

Operational capacity grows 48% YoY to 17.2 GW, reinforcing leadership in energy transition

Greenfield addition of 5.6 GW in CY25, nearly 14% of countrywide solar and wind addition 1

India's top sustainability performer in power generation sector for the second consecutive year in NSE Sustainability ratings

Ahmedabad, 23 January 2026: Adani Green Energy Ltd (AGEL), India’s largest and fastest-growing pure-play renewable energy (RE) company, has announced financial results for the period ending 31 December 2025, showcasing robust growth and operational excellence.

FINANCIAL PERFORMANCE – Q3 & 9M FY26: (Rs. in crore)

| Particulars | Quarterly Performance | Nine Month Performance | ||||

|---|---|---|---|---|---|---|

| Q3 FY25 | Q3 FY26 | % change | 9M FY25 | 9M FY26 | % change | |

| Revenue from Power Supply | 1,993 | 2,420 | 21% | 6,829 | 8,508 | 25% |

| EEBITDA from Power Supply2 | 1,848 | 2,269 | 23% | 6,366 | 7,921 | 24% |

| EBITDA from Power Supply (%) | 91.4% | 90.6% | 92.0% | 91.5% | ||

| Cash Profit3 | 996 | 812 | -18% | 3,639 | 3,906 | 7% |

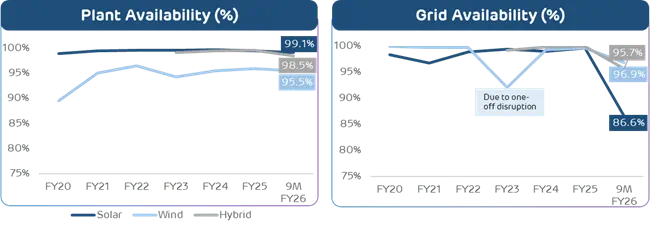

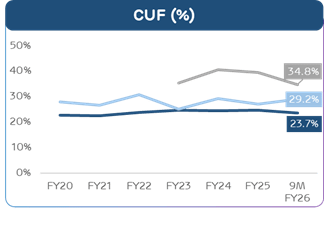

- Strong revenue and EBITDA growth are primarily backed by robust greenfield capacity addition of 5.6 GW, deployment of advanced RE technologies, strong plant performance and commissioning of new capacities in resource rich sites in Khavda, Gujarat and Rajasthan.

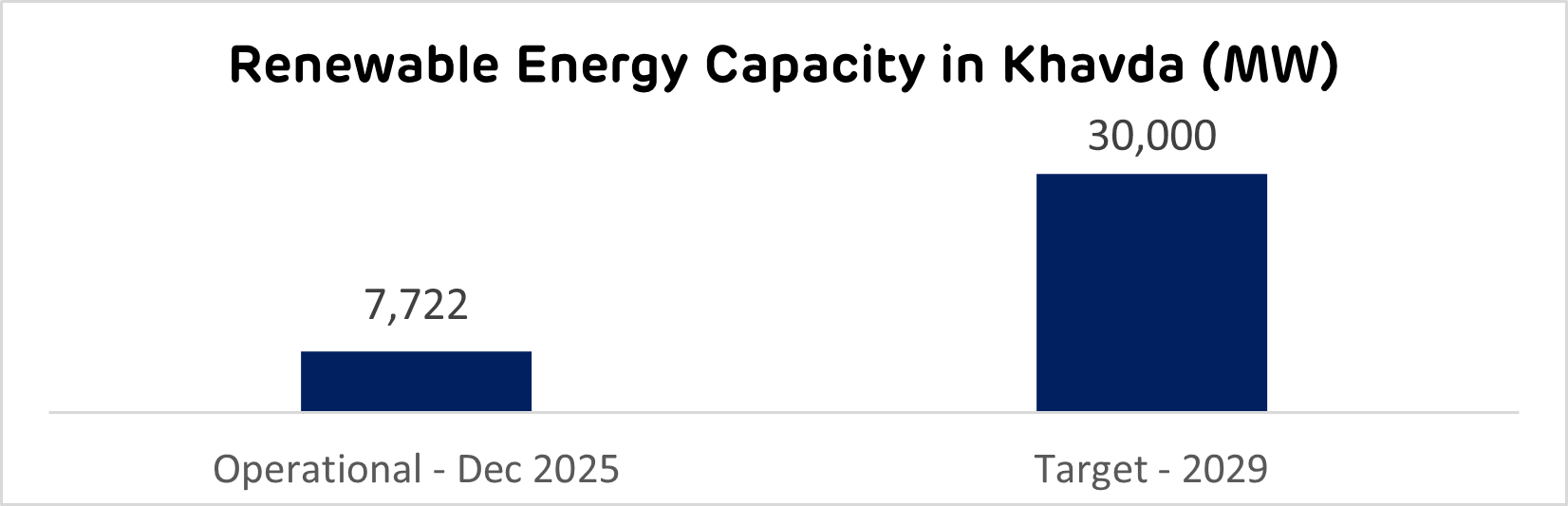

Mr. Ashish Khanna, CEO of Adani Green Energy, stated: “In calendar year 2026, Adani Green Energy has continued its exceptional growth trajectory, adding 5.6 GW of renewable energy capacity—representing nearly 14% of all new solar and wind capacity installed across India. This achievement further cements our position as the country’s leading green energy provider, with our operational capacity now reaching 17.2 GW. Our landmark Khavda project, the world’s largest renewable energy installation, is progressing at an accelerated pace. We are on track for deployment of one of the world's largest single-location battery energy storage project in coming months. Our hydro pumped storage project on Chitravathi river in Andhra Pradesh is also on track.

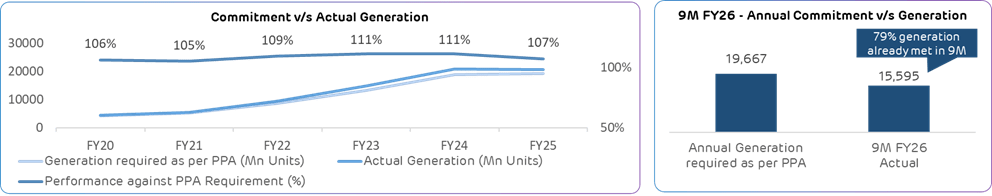

In the first nine months of this financial year, we have generated more than 27 billion units of clean electricity—enough to power a nation the size of Azerbaijan for an entire year. Being recognized as the World’s No. 1 Green Utility in the latest annual rankings by Energy Intelligence is a testament to our commitment to shaping a sustainable future, while consistently creating value for all stakeholders.”

CAPACITY ADDITION & OPERATIONAL PERFORMANCE – 9M FY26:

AGEL added 2,995 MW greenfield capacity in 9M FY26, which is over 90% of capacity addition in entire FY25. The greenfield additions over the last one year were 5,630 MW which included 4,187 MW of solar capacity (3,137 MW in Khavda, Gujarat, 800 MW in Rajasthan and 250 MW in Andhra Pradesh); 462 MW wind capacity in Khavda and 981 MW of solar-wind hybrid capacity in Khavda.

DEVELOPMENT OF THE WORLD’S LARGEST RE PLANT AT KHAVDA:

ESG LEADERSHIP:

Notes:

We Care About Your Privacy

We use cookies to give you the best experience on our website. By continuing, you're agreeing to our use of cookies. For more information read our Privacy Policy or edit your preferences

Essential for site operation. < Enables core functions like security and accessibility.

Remembers your settings like language & region.

Anonymous data to improve performance.

Enhanced features like videos & chat.

Improves outreach & measures engagement.